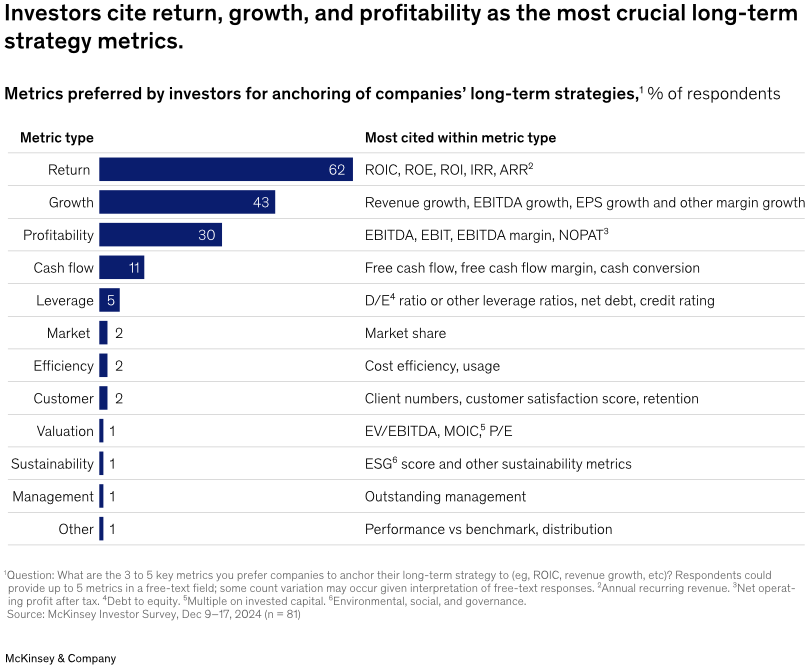

McKinsey’s 2025 investor survey has some unsurprising results: investors “focus on value-creation fundamentals” and “lean on metrics that inform them about return, growth, and profitability”. Sustainability metrics? Um, not so much.

“Overall, investors continue to ask for hard data on the fundamentals that signal a company’s long‑term resilience. The previous survey highlighted cost efficiency, capital productivity, and product innovation as the key engines of future value. In the latest poll, respondents leaned slightly more toward headline profitability metrics—especially return on capital. The direction of travel is, therefore, less a wholesale change than a subtle reweighting: As always, investors care about the underlying levers, but in today’s market, they want to see those levers translated into tangible financial outcomes.

Likewise, whereas respondents in the earlier survey focused on sustainable competitive advantage, superior margins, and disciplined capital allocation, the latest survey shows more concern with a broader rubric of overall financial performance and health….

Across industries and company types, respondents prioritize return, growth, and profitability as the foundation for evaluating a company’s long-term potential. These metrics serve as universal benchmarks for value creation, enabling investors to assess whether a company’s strategy is positioned for long-term success.”

This graphic pretty much says it all, although I suspect most sustainability professionals won’t like it:

See part 2 of this blog for more findings and the methodology for the survey.

Our members can learn more about the business value of sustainability here. In addition, anyone can purchase our newly-released Compendium of Sustainability Financial Disclosures at a very attractive price point – with or without a membership.

If you’re not already a PracticalESG.com member, sign up now and take advantage of our no-risk “100-Day Promise” – during the first 100 days as an activated member, you may cancel for any reason and receive a full refund. But it will probably pay for itself before then.

Members also save hours of research and reading time each week by using our filtered and curated library of ESG/sustainability resources covering over 100 sustainability subject areas – updated daily with practical and credible information compiled without the use of AI.

Are you a client of one of our Partners – SourceIntelligence, TRC, Kumi, Ecolumix, Elm Consulting Group International or Impakt IQ? Contact them for exclusive pricing packages for PracticalESG.

Practical Guidance for Companies, Curated for Clarity.