The Governance & Accountability Institute published a report on the status of sustainability disclosures in the Russell 1000. The 2025 Sustainability Reporting in Focus contains many interesting insights, but these are the high level findings:

“In 2024, 94% of the companies included in the Russell 1000 Index published sustainability reports and data disclosures. Only 6% of this important universe of publicly-traded companies did not report during 2024. Though the number of companies reporting continues to increase, some sectors are progressing more quickly than others…

In 2024, the percentage of Russell 1000 reporters that utilized the GRI Standards held steady at 55% – the same percentage as in 2023… In 2024, G&A found a slight increase in SASB reporters, with the percentage of Russell 1000 reporters aligning with the SASB Standards rising to 82%…

Of the reporters using [ISSB] Standards, alignment solely with IFRS S2 [Climate-related disclosures] was the most common practice. Only two companies aligned solely with IFRS S1 [General Requirements for Disclosure of Sustainability-related Financial Information] and seven companies aligned with both IFRS S1 and S2…

In 2024, 57% of Russell 1000 companies responded to the CDP Climate Change questionnaire, up only one percentage point from 2023. For the S&P 500, the percentage of CDP responders fell to 70% from 74%…

Only 1% of the Russell 10000 applied the TNFD Recommendations in sustainability reporting…

In 2024, 549 Russell 1000 companies referenced the SDGs in their sustainability reporting disclosures, of the companies that referenced the SDGs, 94% directly aligned specific SDGs to their corporate ESG strategy, initiatives, contributions, or other factors. This amounts to 55% of Russell 1000 reporters aligning with specific SDGs, down slightly from 56% in 2023.”

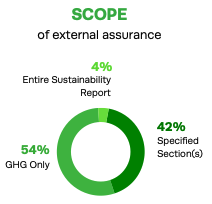

Of those publishing sustainability reports, 51% obtained external assurance – but the assurance scopes differ:

Source: Governance & Accountability Institute 2025 Sustainability Reporting in Focus

With regard to ESRS –

“certain multinational corporations chose to incorporate transitional alignment with ESRS into their reporting in 2024 as they prepared for compliance… Voluntary ESRS alignment in the Russell 1000 was only observed in companies from the S&P 500. One ESRS reporter from the smaller half of the Russell 1000 was subject to mandatory reporting in 2024.”

G&A’s report provides more detail, especially in relation to sector-specific trends. But one thing the report didn’t reflect – how many sustainability reports include financial data rather than merely operational metrics that make up the vast majority of the referenced reporting frameworks.

If you are interesting in more information about how/if companies report sustainability-related financial data, check out our Compendium of Sustainability Financial Disclosures: Over 100 Selected U.S. Publicly Traded Companies.

Interested in a full membership with access to the complete range of benefits and resources? Sign up now and take advantage of our no-risk “100-Day Promise” – during the first 100 days as an activated member, you may cancel for any reason and receive a full refund. But it will probably pay for itself before then.Members also save hours of research and reading time each week by using our filtered and curated library of ESG/sustainability resources covering over 100 sustainability subject areas – updated daily with practical and credible information compiled without the use of AI.

Practical Guidance for Companies, Curated for Clarity.