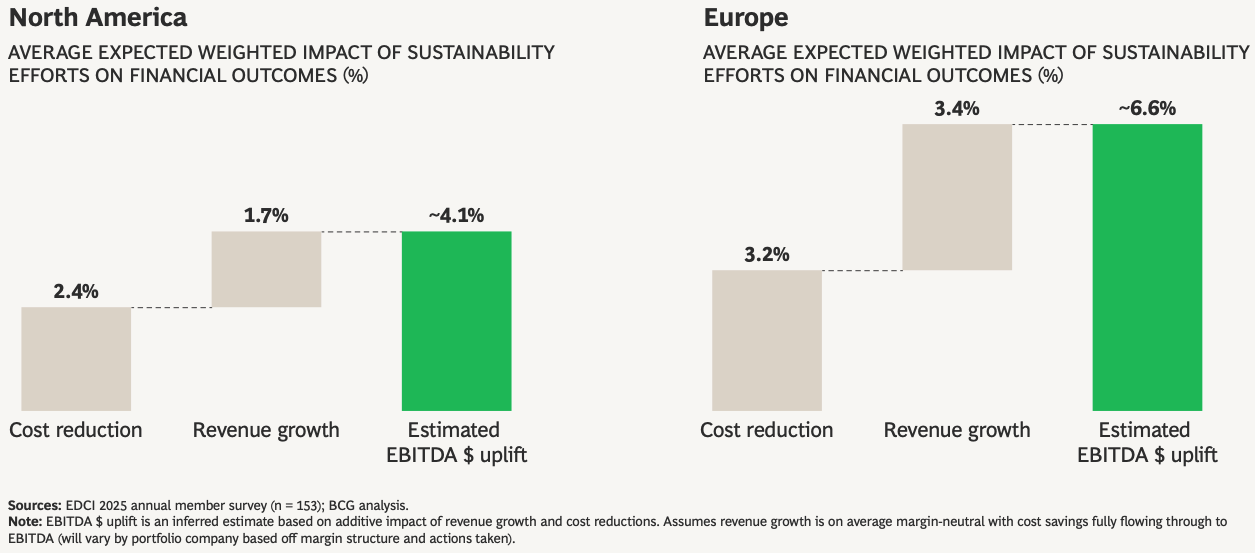

Some compelling data and news from BCG. In their newly-published analysis Sustainability in Private Markets: How Staying the Course Creates Value, the firm reported private equity General Partners (GPs) “estimate that sustainability drives 4% to 7% in realized EBITDA growth over the hold period of their portfolio companies.”

And there is more to consider – private equity firms typically consider multiples of EBIDTA when pricing their buyout offers. A 4%-7% increase in EBITDA can quickly turn into big money.

Great news – but there is something of a catch, as pointed out in the footnote in the graphic above:

Unless sustainability-related revenue growth and cost reductions are explicitly called out in financials, investors and other stakeholders are left to make their own assumptions about the contributions of sustainability initiatives to the bottom line.

BCG’s disclaimer aligns with a couple takeaways from our study showing a surprising lack of sustainability-related financial information reported by US publicly-traded companies:

- “Absent sustainability financial value information from companies directly, investors and ratings organizations are forced to do excess work to convert disclosed operational metrics to financial values and apply their own methodologies, assumptions and guesswork to those conversions. Executives and sustainability professionals are missing an opportunity to reduce investor and ratings research/due diligence efforts, errors/omissions and misinterpretation

- Formally disclosing financial value of sustainability efforts can be a point of competitive advantage — controlling the narrative compared to peer companies that do not report the values, better meeting investor demands and reducing disagreements with ratings agencies.”

Most of the cost and growth opportunities identified by BCG are also highlighted in our study as well.

Interested in a full membership with access to the complete range of benefits and resources? Sign up now and take advantage of our no-risk “100-Day Promise” – during the first 100 days as an activated member, you may cancel for any reason and receive a full refund. But it will probably pay for itself before then.

Members also save hours of research and reading time each week by using our filtered and curated library of ESG/sustainability resources covering over 100 sustainability subject areas – updated daily with practical and credible information compiled without the use of AI.

Are you a client of one of our Partners – SourceIntelligence, TRC, Kumi, Ecolumix, Elm Consulting Group International or Impakt IQ? Contact them for exclusive pricing packages for PracticalESG.

Practical Guidance for Companies, Curated for Clarity.