While I’m talking about reports, Deloitte published their 2025 C-suite Sustainability Report: The next wave of business value. The results offer interesting contrasts between C-suite views compared to what other reports indicate is happening within sustainability functions themselves.

“There has been a slight decrease in the percentage of respondents that say they have undertaken a range of sustainability actions after several years of advancement. Compared to last year, fewer respondents say they are:

– Tying senior leaders’ compensation to sustainability performance: 36% vs. 43% (2025 vs. 2024)

– Requiring suppliers and business partners to meet specific sustainability criteria: 38% vs. 47%

– Decreasing operations emissions by purchasing renewable energy: 42% vs. 49%

– Developing new sustainable products or services: 44% vs. 48%

– Using more sustainable materials: 45% vs. 51%

– Increasing energy efficiency: 45% vs. 49%

– Implementing technology solutions: 46% vs. 50%

Both the obstacles and pressure for action have shifted from prior years. Relatively few executives said that cost or lack of policy support were key barriers to their sustainability efforts, instead pointing to challenges in measuring environmental impacts…

Across nearly every major stakeholder group, fewer respondents today say they are feeling pressure to act on sustainability than in 2022. That includes shareholders (71% in 2022 to 58% in 2025), boards (75% to 60%), governments (77% to 58%), civil society (72% to 57%), customers (75% to 57%), and employees (65% to 54%).”

In contrast to what appears to be a softening in underlying business drivers for sustainability:

“Sustainability investments have continued to increase, particularly in enabling technologies. Sixty-nine percent of respondents say their investments increased slightly (6 –19%), with an additional 14% saying they increased significantly (>20%) – nearly identical to last year. More than one-fifth (22%) of the largest companies (revenues of US$10 billion or more) surveyed said their investments had increased by more than 20% from the prior year.”

Here’s a curveball:

“A relatively small percentage of respondents identified cost (11%) or lack of policy support (13%) as significant obstacles to their sustainability efforts.”

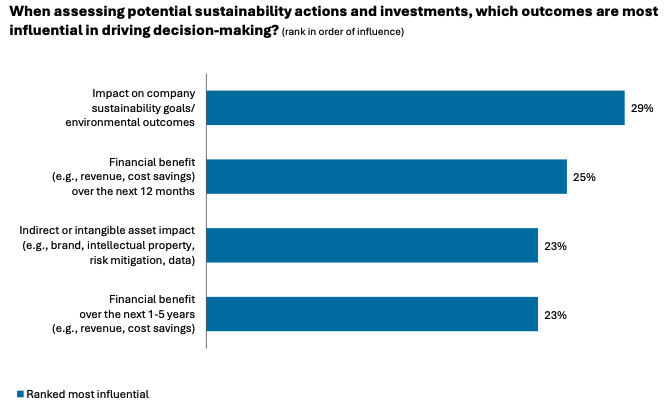

Why are executives willing to increase spending against a backdrop of softening/uncertainty? This chart helps explain:

Source: Deloitte 2025 C-suite Sustainability Report: The next wave of business value.

I dunno – this just seems quite different from what many, many sustainability professionals, recruiters and advisors are experiencing.

Is there a disconnect?

Members can learn more about the business value of sustainability here.

If you’re not already a PracticalESG.com member, sign up now and take advantage of our no-risk “100-Day Promise” – during the first 100 days as an activated member, you may cancel for any reason and receive a full refund. But it will probably pay for itself before then. Members also save hours of research and reading time each week by using our filtered and curated library of ESG/sustainability resources covering over 100 sustainability subject areas – updated daily with practical and credible information compiled without the use of AI.

Practical Guidance for Companies, Curated for Clarity.